Home >>About ATPPF & PF Scheme

::About ATPPF & PF Scheme::

Every individual does not have the capacity or the foresight to carry out a wisely devised plan of savings. Moreover, individuals members of small means can hardly provide effective security against contigencies like old age, death, invalidity and other emergency expenses. These people have to depend on the capacity to work but in a day's work to meet their needs for the day, and that whenever they are not able to be at work, for any reason, whatever they face privation and hardship. It is to meet this type of need that the concept of social security was developed. With this pious objective of providing social security cover to the workers and employees working in the tea gardens of Assam, emerged the Assam Tea Plantations Provident Fund and Pension Fund Scheme

The Assam Tea Plantations Provident Fund and Pension Fund Scheme, the only institutionalized social security cover to the tea garden workers of Assam which came into force w.e.f. 12th Sept.1955 have now passed over more than fifty years of existence with success . in quality and quantity in providing social security to its members. A Journey through a bumpy and thorny road of resistance to a flat pitch, the scheme have an unique experience in turst and security.

After introduction of Provident Fund Scheme in 12th Sept. 1955, a series of legislation have followed with added benefits. Presently the following schemes are providing social security benefit to the workers in the tea estates of Assam.

- Assam Tea Plantations Provident Fund Scheme,1955.

- Pension Scheme,1967.

- Family Pension Scheme", 1972

- Deposit Linked Insurance Scheme,1984

BENEFITS UNDER THE SCHEME:

(a) Provident Fund. Benefits : The Assam Tea Plantation Provident Fund and Pension Fund Scheme is currently providing services to 8,16,948 (as on 31-03-2011) members (approx.). All the employees of a plantation or a tea factory receiving monthly salary upto Rs. 6500/- p.m. and daily wages worker are eligible from the very 1st day of their works to become member of the scheme and entitle to P.F. benefit, (as per amendment vide office order dated 12-10-2009). The employees contributes @ 12% of their wages including dearness allowances, value of food concessions and amount received for plucking tea leaves. The employer contribute at the same rate. It is the duty of the employer to deduct the contributions from the employee and deposit the collected amount alongwith his own share of contribution into the Board's Account within 30 days. If any employer fails to deposit the said amount of P.F. contribution within the prescribed time limit, loss of interest @15% p.a. is charged on that employer for the defaulting period. The members Provident Fund deposits are credited with interest at the rate declared by the Board every year.

In the event of cessation of membership due to retirement, resignation, death, invalidity etc., the Board pays back the amount standing at credit to the member or his nominees with interest. Here, it may be mentioned that payment system has recently been modified to ensure prompt payment to the beneficiaries for which beneficiaries have already been advised through the Managers of all T.Es to furnish their Bank A/C No., Name of the Banker and Branch with IFS code so that amount in question may be credited into the A/C of concerned beneficiaries.

(b) Pensionary Benefit: The pension including Family Pension Scheme came into force with effect from 01-04-1972. Two types of Pensionary benefits are provided under the scheme.

One is withdrawal benefit and the other is family pension benefit. The first one is paid retirement and resignation and the later one is paid on death of the member while in service.

A member is entitled to full Pensionary benefit (withdrawal) if he/she retires at the age of 58 years and completed 25 years of membership in the Provident Fund. In the event of cessation of membership before attainment of the age of 58 years, the Pensionary benefits are paid as per prescribed schedule.

In the event of death of a member while in service, subject to completion of one year of membership in Provident Fund, the widow/widower/son/daughter as the case may be is paid family pension benefit @ Rs. 175/- to 450/- p.m. depending on the amount of P.F. balance at credit at the time of death of the member, alongwith a lump sum amount of Rs. 2000/-. The payee (spouse) shall continue to enjoy the benefit till death or remarriage or attainment of age of 18 years in respect of son and 21 years in respect of unmarried daughter if the payee was minor at the time of death of the member, legal guardian of the minor payee is allowed to draw the amount of family pension money on behalf of minor payee.

The unique feature of the scheme is the resources for building the pension fund. Neither the employee nor the employer are required to contribute to the funds. The fund is built up out of surplus interest from investment and contribution from the Govt. of India. The Board and Govt. of India contribute at the rate of 2-1/3 % and 1-1/6% respectively of the total wages of the members at the Provident Fund scheme. In addition to these two types of pension benefits as mentioned above, a member is paid Invalid Pension @ Rs. 100/- p.m. if the member becomes invalid while at work due to accident or any unforeseen reason.

(C) Deposit Linked Insurance Benefit: This scheme came into force with effect from 1st of February, 1984. The Scheme is applicable to all P.F. members under the Assam Tea Plantation Provident Fund Scheme. In the event of death of an employee who is a member of the P.F. Scheme with a minimum P.F. balance of Rs. 1000/- at credit, the nominee be paid the assurance benefit under the scheme equal to the amount of balance in the deceased members P.F. account subject to the maximum of Rs. 30,000/-. This is an employer liability scheme. The employer contribute @ .5% of the total wages of the

members into the Insurance Fund. The Government of India contributes .25% of the total wages of the members. The beneficiaries need not contribute to the fund.

Before starting the DLI Scheme, Life Insurance Scheme was formulated under special arrangement with the Life Insurance Corporation of India. The members are covered under 20 years endowment policies. The members need not pay the premiums separately. The premium due is deduced from the P.F. accumulations of the insured member and deposited to the Life Insurance Corporation of India. In the event of death of a member, the nominee is paid the policy value irrespective of the amount of premium paid. At the time of maturity, the sum assured is paid back to the member with bonus.

MAINTENANCE OF MEMBERS AMOUNT: The accounts of the individual members are maintained at garden level. The employer have to maintain a Provident Fund ledger wherein the P.F. contributions of the members are recorded. The ledger is timely checked and verified by the auditors and the Inspectors of the Board. At the end of the year, the employer have to prepare a statement of account of the members in prescribed Form recording the total contribution of each member during the accounting year and interest credited at the rate declared by the Board. Every employer has to submit the said annual statement of account to the Board authority after being verified and certified by the auditor of the Board.

On receipt of the certified annual statement of individual accounts, the Board authority send the same to Computer Cell for rechecking and for preparing individual receipts of P.F. balance. If the accounts are found in order, the Individual Receipts are sent to the employers for distribution among the concerning members.

RECOVERY ACTION ON THE DEFAULTERS: The process of recovery of the defaulting amount begins with correspondence, which may end up in the court. In the primary stages the defaulting employers are reminded about their defaulting amount with an advice to deposit the same immediately. Failure on the part of the employer to respond to the reminders invites Bakijai or Criminal Prosecution. Under the Bakijai Proceedings, the defaulting amounts are recovered by District Collectors as if arrear of land revenue under the instruction from the Chairman, Board of Trustees.

The ATPPF and PF Scheme provides for. levying damage as penalty against the liquidated certificated dues. The Chairman, Board of Trustees fix the quantum of charge on the damage.

In some cases, both Bakijai and Criminal prosecutions are initiated against the chronic defaulters for prompt recovery of the defaulted dues.

SETTLEMENT OF CLAIMS: The claims of P.F. , Pension and Deposit Linked Insurance

are settled on receipt of the application through his/her employer. However different

procedures are followed for settlement of different claims. The process of settlement of

claims in respect of P.F. and Pension, starts at Inspectorate and Zonal level. On

completion of necessary paper works and proper scrutiny of the member A/C etc and other relevant matters, the claims are forwarded to the Head Office for settlement. However in case of P.F. Settlement, the employer is permitted to settle the case at garden level from the periodical collections, provided this ceased members account are verified and recommended by the respective Field Offices if the collections cover the entire amount required for settlement. In case of Deposit Linked Insurance, the applications are directly sent to the Head Office through the employer.

All the payments of Rs. 5000/- and above are made to individual Bank A/C of the payees. Amount below Rs. 5000/- are sent to the employer for cash disbursement in presence of Primary Committee members.

LOAN AND ADVANCES TO THE MEMBERS: The members under the Provident Fund Scheme are granted P.F. advances for marriage, death ceremony, special medical treatment, higher education of children etc, upto a maximum limit of 25% of P.F. balance at credit of the members account or nine months pay whichever is less. No such advance shall be granted if recovery of a previous advance is continuing. Board also grant nonrefundable P.F. advances for construction or purchase of a dwelling house. The quantum of advances shall be equivalent to 24 month wage of the member or his own total contribution or the cost of the dwelling house whichever is less:

Beside this, non-refundable advance is also granted to a member in the case of his/her hardship due to natural calamity or closure of a plantation or factory.

INVESTMENT: The Trust Fund are invested in Government Securities and Bonds under the guidelines of the Indian Trust Act 1882. The policies pertaining to the investment of the Trust Fund are made by the Investment Committee of the Board comprising the Chairman and other selected members.

ADMINISTRATION OF THE SCHEME: The Assam Tea Plantation Provident Fund and Pension Fund Scheme is administered by a Board of Trustees consisting of the representatives of the employees, employers and the state government. There are also an Investment Committee, an Executive Committee and other sub-committees to deal with specific subjects. The Secretary-Cum-P.F. Commissioner is an ex-officio member of the Board and Chief Executive of the Organisation. The administration of the scheme is organised in three tier setup: the Head Office level, Zonal Office level and inspectorates level. In the Head Office, the Chief Executive is assisted by senior Officers like Addl. P.F.Commissioners and Deputy P.F. Commissioners. The Zonal Offices are headed by the Assistant Provident Fund Commissioner. He is assisted by the junior officers like Fund Control Officer, Assistant Fund Control Officer and Auditors. The Head Office provides guidelines and procedures for the operation of the Zonal and Inspectorate Offices. The Zonal and Inspectorates Offices do all the preliminary works required for settlement of P.F. and Pension claims. They maintain records of the periodical statement of accounts of each and every T.E. under their jurisdiction. The Zonal Officer submit defaulter list to the Head Office from time to time. The Zonal as. well as the Inspectorate Offices exercise constant vigilance to ensure strict compliance of the provisions of Social Security scheme in plantations including tea factories. The Officers of the Zonal and Inspectorate Offices visit the garden/factories for general inspection of records relating to different social security schemes and submit comprehensive report to the Head Office. Board has a publicity wing for familiarization of the Social Security benefit among the tea garden workers. The immediate settlement of grievances is the top priority in the day to day affairs of the Head Office as well as of Zonal and Inspectorate Offices.

The Head Office organises seminars and conference of the Officers of the Board where the officers from Zonal Offices and Inspectorates exchange their views and the problems faced by the officers while implementing the schemes are discussed. In order to keep pace with the changing scenario of the Social Security in Assam in particular and India in general, the Board send its officers to attend the training programmes and seminar inside and outside the country.

COST OF ADMINISTRATION

The cost of administration is entirely borne by the employer as far as the Provident Fund Scheme is concerned. The Administrative charges at the rate of 3.5% on the annual Gross P.F. contribution is collected from the employers. The Government of India bear the entire cost of administration of the pension scheme. The cost of administration of the Deposit Linked Insurance Scheme is partly borne by the employer and partly by the Government of India @ 0.1% and .05% respectively.

TRENDS AND DEVELOPMENTS: Constant efforts are on to expand the scope of coverage of all workers in plantation and factories. The process for suitable amendment of the statutory provision pertaining to the period of service required for entitlement of P.F. benefit has started in order to extend the P.F. benefit to the workers from the very first day of working. In this connection, the Board authority is also contemplating to make amendment of certain provision by doing away with the requirement of specific area for coverage of a Plantation under the Act.

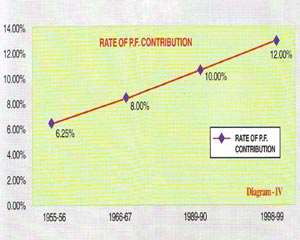

Efforts are also being made to reduce the length of time required to complete the settlement process and considering the various problems therein viz. delay in payment, fraudulent drawal of amount of P.F. and Pensionary money remitted to the beneficiaries, entire payment system in respect of settlement of P.F. and Pension Scheme has been modified and such new payment system has already commenced, wherein a beneficiary now need to furnish his/her bank A/C, Name of the banker with IFS code through his/her respective garden management and after proper verification of all the papers relating to his/her accounts etc. received from respective Field Office, Board will credit the amount of P.F./Pension of beneficiary directly into his/her account so that beneficiary can draw the amount properly and easily. Board has already stepped on the path of computerization, The pension scheme has been computerized. The annual statement of individual members accounts are also checked in the computer and the members are provided computerized individual receipts. More branches as well as Field Offices are likely to be covered by computer in phased manner in the near future. The rate of P.F. contribution has since been raised from 6 1/4th% to 12%, The maximum amount payable under Deposit Link Insurance Scheme has also been raised from 10,000/- to Rs. 30,000/-. The concept of welfare is always kept in mind by the staff and executive of the organisation and with this view, the Board authority has opened two new Cells, Namely (i) Training & Research Cell and (ii) Inspection & Enforcement Cell for necessary training to raise the skill & efficiency of the Officers and Staff to promote the working efficiency of the organisation and to achieve it's goal. The members have an easy access to the Zonal heads and the Chief Executive in Head Office as and when they feel.

Further, since the existing system of recovery through Bakijai proceedings does not work in an effective way and it involves a lot of delay for recovery of the arrear dues, the Board authority is seriously considering the procedures of recovery of arrear/defaulted due etc. followed by the EPFO. A sub committee has already been formed to examine and suggest necessary amendment of the Act with a view to expedite the process of recovery by the Board itself.

The Assam Tea Plantation Provident Fund and Pension Fund Scheme is an well administered and most comprehensive Social Security Scheme for 9 lakhs or more tea garden workers working in tea gardens all over the State.

Notice

|

|